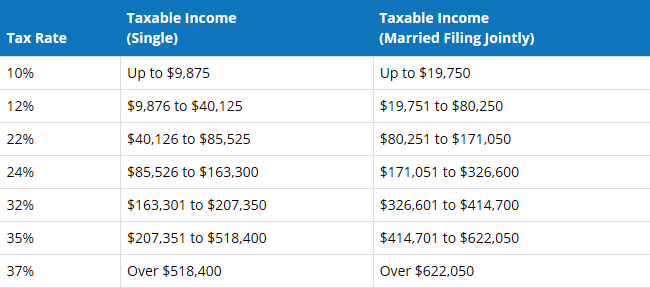

Single taxpayers and married individuals filing separately: $12,950.Federal Corporate Income Tax Rates & Brackets, 1909-2020. There are seven federal income tax brackets. Married couples filing jointly: $25,900 A tax bracket is the range of incomes taxed at given rates, which typically differ depending on filing status.The above rates apply to taxable income, after the standard deduction (or itemized deductions) and other tax breaks have been taken. The IRS also announced that the standard deduction for 2022 was increased to the following: You will pay tax on only 85 percent of your Social Security benefits, based on Internal Revenue Service (IRS) rules. The income thresholds for the 2023 tax brackets were adjusted significantly up about 7. Your state may have different brackets, no taxes at all or a flat rate. There are seven tax rates: 10, 12, 22, 24, 32, 35 and 37, the same as in tax year 2022. These are the rates and income brackets for federal taxes.

2022 TAX BRACKETS IRS FREE

Log in to get your tax forms IRS website Free IRS publications. 32% Taxable income between $170,050 to $215,950 Get help understanding 2022 tax rates and stay informed of tax changes that may affect you.22%: Taxable income between $41,775 to $89,075 On Wednesday the IRS released the amounts for tax brackets and standard deduction for 2022.

0 kommentar(er)

0 kommentar(er)